Business Plan

Hyperpressed Brick Production in the Czech Republic

Environmentally friendly and energy-efficient production of building materials, compliant with European Union standards and “green” construction programs.

Project Summary

Company Description

- Legal Base: Company registered in the Czech Republic

- Legal Form: S.r.o.

- Company Name: 4Bricks

- Location: Prague

- Mission: Transition of the construction industry to sustainable materials through innovation

Team

- Dmytro Levchenko — Technical Director

- Sergii Latanskyi — Financial Director

- Devid Homa — Sales Manager

- Kevin Beresh — Product Promotion in Target Markets (Czech Republic, Germany, EU)

Product Description

M100–M300 kg/cm²

F150–F300

3–5 %

Use of recycled raw materials

Advantages over traditional brick:

- 40 % lower energy consumption in production

- Precision geometry (±0.5 mm) allows mortar savings

Sustainability and Standards

- Certification: Products certified under EU standards

- Certificates: EN 771-3, Blue Angel (expected in 2025)

- Carbon footprint: 70 % lower than traditional brick

- Production cycle: Use of up to 90 % recycled raw materials

Target Market

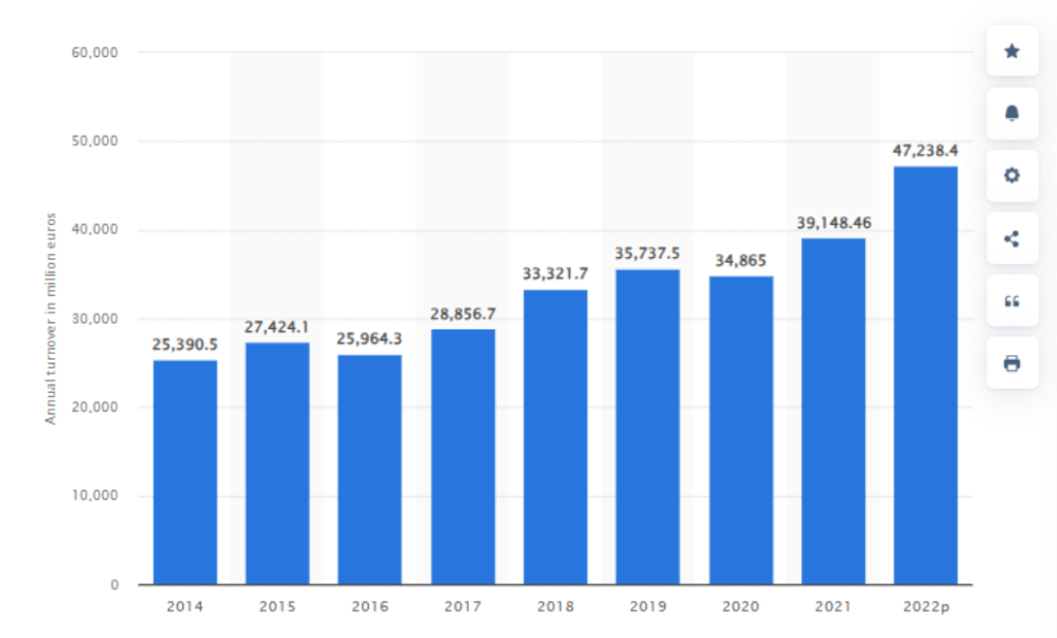

| Region | Industry Turnover | Growth |

|---|---|---|

| Czech Republic (2022) | €8.1 billion | +20.66 % |

Source: Statista

Demand for energy-efficient construction:

According to the EU Directive on the Energy Performance of Buildings (EPBD), since 2021 all new buildings in EU countries must be nearly zero-energy (nZEB — nearly Zero-Energy Buildings).

- Requires EU countries to implement nZEB standards

- Links building permits to energy efficiency compliance

- Encourages the use of innovative building materials

- Supported by EU funding and national programs

Challenges of the Construction Industry in the Czech Republic

1. Labor Shortage

The construction sector faces a shortage of qualified personnel, leading to delays and increased project costs.

2. High Cost of Materials

Prices for bricks, cement, and other traditional materials continue to rise, increasing the overall cost of construction.

3. Long Construction Timeframes

Traditional construction methods take considerable time, especially for masonry and installation of structural elements.

4. Strict Environmental Standards

Stringent environmental requirements increase costs for designing and implementing eco-friendly solutions.

Features and Applications

High load resistance and durability.

Accurate dimensions and shape ensuring easy installation.

Applications

- Building facade cladding

- Construction of internal walls for low-rise buildings

- Partition walls, fences, and garages

- Agricultural facilities

- Warehouse construction

- Other architectural and construction tasks

Technical Specifications

| № | Name | Dimensions (mm) | Type |

|---|---|---|---|

| 1 | Standard Brick | 250 × 125 × 65 | Hollow |

| 2 | Grooved Brick | 250 × 125 × 65 | Hollow |

| 3 | Ridge Brick | 250 × 125 × 65 | Solid |

Sales Market

- 0–12 months: entry into the local Czech market

- 12–18 months: expansion into the EU market (Germany, Netherlands, France)

- Long-term: export beyond Europe

Market Analysis

Czech Republic: increasing interest in eco-friendly materials, projected construction growth +3% annually (2025–2028).

Germany: expected growth of the “green” building materials market by more than €11 billion by 2029.

Demand Forecast

- Target production capacity: 35,200+ bricks per month

- Average selling price: €1.50 per brick

- Product type: single-row hollow brick (250 × 125 × 65 mm)

Applications

- Facade cladding

- Walls and partitions

- Landscape design

- Interiors

- Industrial and warehouse facilities

Seasonality of Sales in the Czech Republic

| Month | Sales Activity (%) | Comment |

|---|---|---|

| January | 10% | Construction almost frozen |

| February | 15% | Season preparation |

| March | 40% | Project launches |

| April | 70% | Mass start |

| May | 90% | Peak demand |

| June | 100% | Maximum activity |

| July | 95% | High demand |

| August | 90% | Slight decrease |

| September | 80% | Season wrap-up |

| October | 50% | Shift to logistics |

| November | 25% | Finishing works |

| December | 15% | Final shipments |

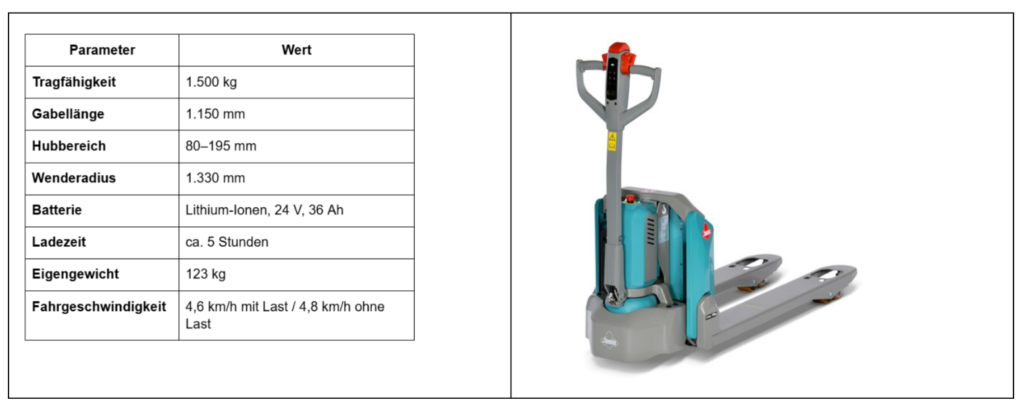

Equipment

🧰 Equipment

The production of hyperpressed bricks is based on the use of hydraulic presses, ensuring high product quality and productivity.

Technological Equipment: Press

The press “5BRICKS” produces up to 200 bricks per hour using the semi-dry pressing method. It is simple to operate, safe, economical, and reliable.

Scope of Supply:

- Two molds:

- Standard LEGO brick with reinforcement groove

- Special mold for lintels and channels (pipes, cables)

- Continuous adjustment of loading volume and pressing of bricks up to 88 mm in height

Features:

- Mold change: 5–10 minutes

- Products meet state standards with proper technology application

- Technical specifications: see table

Additional Equipment

- 🔧 Brick-making machine

- 🔄 5Steine 250 Mixer

- 🧹 5Steine 100 Sieve

- 📥 VIBRO loading hopper

- 💨 Compressor

- 🚛 Electric stacker (Ameise)

Table 1: Equipment

| Item | Quantity | Cost (€) |

|---|---|---|

| Press machine | 1 | 5,083.00 |

| Belt conveyor L340 | 1 | 1,927.00 |

| Mixer | 1 | 2,890.00 |

| Vibrating sieve | 1 | 1,683.00 |

| Compressor | 1 | 170.00 |

| Loader | 1 | 1,500.00 |

| Total (including -15% discount) | 11,265.00 |

Table 2: Power Consumption

| Consumer | Qty | Power (kWh) | Factor | Shift (8h) | Month (22 days) | €/kWh | €/shift | €/month |

|---|---|---|---|---|---|---|---|---|

| Press | 1 | 4.0 | 0.9 | 28.8 | 633.6 | 0.22 | 6.34 | 139.39 |

| Mixer | 1 | 3.0 | 0.7 | 16.8 | 369.6 | 0.22 | 3.70 | 81.31 |

| Sieve | 1 | 0.5 | 0.7 | 2.8 | 61.6 | 0.22 | 0.62 | 13.55 |

| Conveyor | 1 | 0.5 | 0.7 | 2.8 | 61.6 | 0.22 | 0.62 | 13.55 |

| Compressor | 1 | 0.4 | 0.7 | 2.24 | 49.28 | 0.22 | 0.49 | 10.84 |

| Lighting | - | 1.0 | 0.7 | 5.8 | 123.2 | 0.22 | 1.28 | 27.10 |

| Total | 58.48 | 1,287.0 | 6.43 | 220.80 |

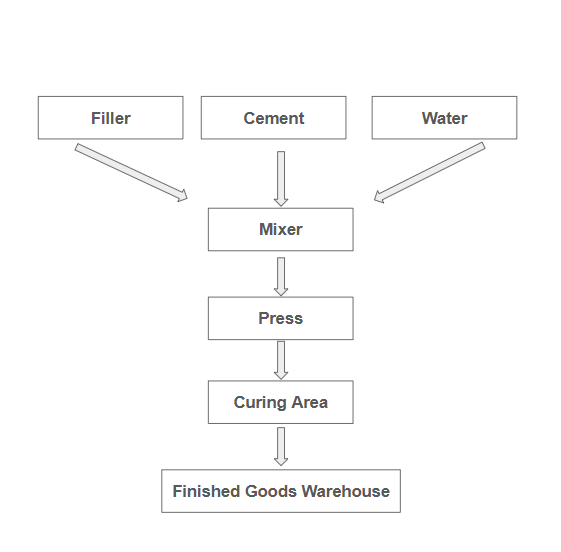

Production Line Stages

- Raw material storage

- Concrete mix preparation unit

- Molding unit

- Initial brick curing area

- Finished product warehouse

Technical Specifications

- Size: 250 × 125 × 65 mm (standard, hollow or solid)

- Weight: ~3.5 kg

- Composition: cement, limestone screenings, water, plasticizer

- Color: standard grey, colored versions available

- Production capacity: up to 35,200 bricks per month

- Lead time: 5–7 working days for standard volume

Standards and Documentation

- EN 771-3

- Blue Angel (certification in process)

- Warranty obligations

- Technical data sheet

- Adaptation for tender documentation available

Advantages in the Czech and EU Context

4Bricks Hyperpressed Brick — an innovative material for energy-efficient and eco-friendly construction across the Czech Republic and the European Union.

- Frost resistance F150–F300: suitable for regions with harsh climates (Czech Republic, Germany, Poland)

- Sustainability: 70% CO₂ reduction, recycled materials

- Cost-efficiency: ±0.5 mm geometry reduces mortar consumption by up to 30%

- Aesthetics: smooth texture, coloring options, suitable for facades and interiors

- Innovation: optional channels for reinforcement, wiring, and utilities

Logistics and Packaging

- Delivered on pallets (336–420 pcs per pallet)

- Packaging: stretch film, branded labeling

- Distribution across the Czech Republic and EU

- Support for project calculations and documentation

Conclusion

4Bricks Hyperpressed Brick is a strategically important material for new European construction standards. It combines sustainability, durability, and precision, making it ideal for both public and private projects.

- Municipal clients

- Developers

- Construction contractors

- Architects and design offices

Stages of the Technological Process

1. Raw Material Storage

Raw materials (cement, fillers — sand, clay, limestone screenings, pigments) are delivered to the mixing preparation area.

2. Preparation of the Concrete Mix

- Crushing and sieving of dry filler

- Dosing and loading of filler into the mixer

- Dosing and loading of cement and additives

- Moistening of the mix

3. Molding

The prepared mix is fed into the press hopper. The mix should not sit idle for more than 15–20 minutes.

4. Pressing

The forming process is carried out under a pressure of 10–15 tons, which ensures precise shaping and high strength of the finished brick.

Finance and Cost Price

Table 3. Cement Prices in the Czech Republic and Germany

| Cement Grade | Volume | Czech Republic (CZK) | Czech Republic (EUR) | Germany (EUR) |

|---|---|---|---|---|

| CEM II 32,5 R | 1 kg | 5.02 | 0.20 | 0.60 |

| 25 kg | 125.45 | 5.02 | 14.90 | |

| 1 t | 5 020 | 200.80 | 600 | |

| CEM I 42,5 R | 1 kg | 6.30–6.38 | 0.25–0.26 | 0.79 |

| 25 kg | 157.69–159.43 | 6.30–6.38 | 19.80 | |

| 1 t | ~6 300–6 380 | ~252–255 | ~790 |

Table 4. Cost of Producing One Brick

Proportions cement : sand = 1:5. Including plasticizer and pigment

| Indicator | Weight per 1 brick (kg) | For 1,600 bricks | For 35,200 bricks | €/kg | €/pc | €/1,600 | €/35,200 |

|---|---|---|---|---|---|---|---|

| Cement | 0.583 | 933 | 20,522 | 0.22 | 0.128 | 204.80 | 4,505.60 |

| Sand | 2.917 | 4,667 | 102,941 | 0.02 | 0.058 | 92.80 | 2,041.60 |

| Plasticizer C-3 | 0.0029 | 4.664 | 102.61 | 2.00 | 0.0058 | 9.28 | 204.16 |

| Pigment | 0.0012 | 1.92 | 42.24 | 0.23 | 0.00028 | 0.45 | 9.86 |

| TOTAL | 3.5 kg | – | – | – | 0.19 | 307.33 | 6,761.22 |

* Without pigment, the cost price decreases by approximately 3%

Table 6. One-Time Costs

| Item | Amount (€) | Description |

|---|---|---|

| Equipment | 11,265 | Press, mixer, sieve, conveyor |

| Delivery to Germany | 1,000 | Transport costs |

| Customs services | 3,000 | Services |

| Compressor + equipment | 160 | Compressor |

| Tools | 310 | Shovels, buckets, wheelbarrow, consumables |

| Protective equipment | 100 | Shoes, clothing, glasses, headphones |

| Loader, pallets, drying | 1,400 | – |

| TOTAL | 17,235 | – |

Table 7. Marketing, Certification, Equipment

| Item | Amount (€) | Description |

|---|---|---|

| Website and social media | 500 | Landing page + social media (FB, IG, LinkedIn) |

| Domain and hosting | 100 | 1 year |

| Certification | 2,000 | EN 771-3, laboratory |

| Office equipment | 200 | Printer, MFP |

| TOTAL | 2,800 | Or €2,700 including hosting |

Total One-Time Costs: €20,035

Monthly Expenses and Seasonal Calculation

Table 8. Payroll Fund

| Position | Headcount | Gross (€ / month) | Total (€ / month) | Employment Type |

|---|---|---|---|---|

| Manager | 1 | 2,400 | 2,400 | Staff |

| Press Operator | 1 | 1,200 | 1,200 | Staff |

| Mixer Operator | 1 | 1,200 | 1,200 | Staff |

| Marketer | 1 | 500 | 500 | Outsourcing |

| Accountant | 1 | 500 | 500 | Outsourcing |

| TOTAL | 5 | – | 5,800 | – |

Table 10. Equipment Depreciation

Equipment depreciation: 5% per year = €661.60 / year or €55.13 / month.

Table 11. Insurance Expenses

| Category | Czech Republic (CZK/year) | Czech Republic (€) |

|---|---|---|

| Equipment | 30,000 | ~1,200 |

| Corporate Liability | 12,000 | ~480 |

| TOTAL | 42,000 | ~1,680 |

Marketing Budget

| Target Audience | Channel | Description | Monthly Budget (€) | Annual Budget (€) |

|---|---|---|---|---|

| B2C | Facebook / Instagram Ads | DIY targeting | 200 | 2,400 |

| YouTube + Content | Videos, reviews | 150 | 1,800 | |

| B2B | Email Campaign + PDF | Catalogs, email | 100 | 1,200 |

| Professional Media | Stavitel, ČKA | 100 | 1,200 | |

| All | SEO + Website | Optimization, blog | 100 | 1,200 |

| Google Ads | Retargeting | 100 | 1,200 | |

| Exhibitions | Twice a year | – | 2,500 | |

| TOTAL | 750 | ~11,500 | ||

* Raw material delivery ≈ €0.50/km. Plan: 5 deliveries per month.

Raw Material Volume Calculation Considering Seasonality

| Month | Activity (%) | Production (pcs) | Raw Material Weight (kg) | Raw Material Weight (t) | Comment |

|---|---|---|---|---|---|

| January | 10% | 3,520 | 12,355 | 12.36 | Warehouse shipments |

| February | 15% | 5,280 | 18,533 | 18.53 | Season preparation |

| March | 40% | 14,080 | 49,453 | 49.45 | Project launches |

| April | 70% | 24,640 | 86,486 | 86.49 | Mass construction |

| May | 90% | 31,680 | 111,197 | 111.20 | Peak season |

| June | 100% | 35,200 | 123,552 | 123.55 | Maximum activity |

| July | 95% | 33,440 | 117,364 | 117.36 | Private sector |

| August | 90% | 31,680 | 111,197 | 111.20 | Activity decrease |

| September | 80% | 28,160 | 98,842 | 98.84 | Season completion |

| October | 50% | 17,600 | 61,776 | 61.78 | Warehouse period |

| November | 25% | 8,800 | 30,888 | 30.89 | Minimal construction |

| December | 15% | 5,280 | 18,533 | 18.53 | Final shipments |

| TOTAL | – | 269,440 | 939,177 | 939.18 | – |

Seasonality of Brick Sales in the Czech Republic

Key Findings

- Peak sales: April–August (especially May–July)

- Stock purchases: February–March and October

- Lowest activity: January and December

Strategic Focus:

- B2C: promotion of facade solutions — autumn

- B2B: tenders are planned in winter, launched in spring

Cost Structure

1. One-time (capital) expenses

- Equipment: press, mixer, screener, etc.

- Delivery and customs: logistics and clearance

- Commissioning: line installation

- Tools: shovels, buckets, protection

- Handling equipment: stacker

- Drying equipment: pallets, panels

- Marketing: website, social media

- Certification: EN 771-3, eco-labels

- Office: equipment, furniture

2. Operational monthly expenses (OPEX)

- Raw materials: cement, sand, pigment, plasticizer

- Payroll: manager, operators, accountant

- Energy: equipment, lighting

- Rent: workshop, warehouse, office

- Transport: 5 deliveries/month at €0.50/km

- Maintenance: oil changes, parts replacement

- Insurance: liability and equipment

- Utilities: water, inventory

- Marketing: promotion, exhibitions

- Depreciation: 5% per year

3. Cost Classification

| Category | Type | €/month (100%) | Comment |

|---|---|---|---|

| Raw materials | Variable | 6,761 | Depends on volume |

| Payroll | Fixed | 5,800 | Constant staff |

| Rent | Fixed | 600 | Unchanged |

| Energy | Variable | 221 | By shifts |

| Logistics | Variable | 100 | Raw material transport |

| Insurance (equipment) | Fixed | 100 | Allocated |

| Insurance (liability) | Fixed | 40 | — |

| Marketing | Fixed | 750 | Promotion |

| Depreciation | Fixed | 55 | 5% per year |

4. Monthly Expenses Considering Seasonality

| Month | Load (%) | Production (pcs) | Raw Materials (€) | Salaries (€) | Energy (€) | Rent (€) | Marketing (€) | Other (€) | Total (€) |

|---|---|---|---|---|---|---|---|---|---|

| January | 10% | 3,520 | 1,433 | 2,400 | 139 | 600 | 300 | 800 | 5,672 |

| February | 15% | 5,280 | 2,150 | 2,400 | 180 | 600 | 300 | 800 | 6,430 |

| March | 40% | 14,080 | 5,740 | 4,800 | 220 | 600 | 500 | 1,200 | 13,060 |

| April | 70% | 24,640 | 10,040 | 4,800 | 220 | 600 | 700 | 1,300 | 17,660 |

| May | 90% | 31,680 | 12,900 | 4,800 | 220 | 600 | 700 | 1,300 | 20,520 |

| June | 100% | 35,200 | 14,430 | 4,800 | 220 | 600 | 700 | 1,300 | 22,050 |

| July | 95% | 33,440 | 13,710 | 4,800 | 220 | 600 | 700 | 1,300 | 21,330 |

| August | 90% | 31,680 | 12,900 | 4,800 | 220 | 600 | 700 | 1,300 | 20,520 |

| September | 80% | 28,160 | 11,540 | 4,800 | 220 | 600 | 600 | 1,200 | 19,160 |

| October | 50% | 17,600 | 7,220 | 4,800 | 200 | 600 | 500 | 1,000 | 15,120 |

| November | 25% | 8,800 | 3,610 | 2,400 | 180 | 600 | 400 | 900 | 8,090 |

| December | 15% | 5,280 | 2,150 | 2,400 | 150 | 600 | 400 | 800 | 6,500 |

| TOTAL | – | – | – | – | – | – | – | – | 175,112 |

Marketing Strategy

Target Audience

- B2B: construction companies, architects, developers

- B2C: private builders (cottages, townhouses)

- B2G: government and municipal clients

Unique Selling Proposition

- Fast masonry due to precise geometry

- Mortar savings thanks to perfect shape

- High strength, aesthetic appearance, frost resistance

- Eco-friendly: no firing, low CO₂ emissions

Sales Geography

- Main markets: Czech Republic, Germany (Bavaria)

- Additionally: Austria, Slovakia, southern Poland

Promotion Channels

| Audience | Channels | Examples |

|---|---|---|

| B2B | Exhibitions, newsletters, media | For Arch, BAU, Stavitel, BauNetz |

| B2C | Social media, YouTube, SEO | Facebook, YouTube (video case studies) |

| B2G | Tender platforms, forums | NEN, TenderArena, Zelená úsporám |

Key Performance Indicators (KPIs)

- Increase website leads by +20% per quarter

- Participate in at least 3 industry exhibitions per year

- Engage 5+ architectural bureaus as partners

- Participate in 10+ tenders annually

- 50,000+ reach of advertising campaigns on social media

Cash Flow 2025

| Month | Sales (pcs) | Revenue (€) | Materials (€) | Salaries (€) | Other (€) | Total Costs (€) | Profit (€) | Cumulative Profit (€) |

|---|---|---|---|---|---|---|---|---|

| January | 3,520 | 5,280 | 676 | 5,800 | 1,866 | 8,342 | -3,062 | -3,062 |

| February | 5,280 | 7,920 | 1,014 | 5,800 | 1,866 | 8,680 | -760 | -3,821 |

| March | 14,080 | 21,120 | 2,705 | 5,800 | 1,866 | 10,371 | 10,749 | 6,927 |

| April | 24,640 | 36,960 | 4,731 | 5,800 | 1,866 | 12,397 | 24,563 | 31,491 |

| May | 31,680 | 47,520 | 6,082 | 5,800 | 1,866 | 13,748 | 33,772 | 65,263 |

| June | 35,200 | 52,800 | 6,758 | 5,800 | 1,866 | 14,424 | 38,376 | 103,639 |

| July | 33,440 | 50,160 | 6,413 | 5,800 | 1,866 | 14,079 | 36,081 | 139,719 |

| August | 31,680 | 47,520 | 6,082 | 5,800 | 1,866 | 13,748 | 33,772 | 173,492 |

| September | 28,160 | 42,240 | 5,407 | 5,800 | 1,866 | 13,073 | 29,167 | 202,659 |

| October | 17,600 | 26,400 | 3,379 | 5,800 | 1,866 | 11,045 | 15,355 | 218,014 |

| November | 8,800 | 13,200 | 1,690 | 5,800 | 1,866 | 9,356 | 3,844 | 221,859 |

| December | 5,280 | 7,920 | 1,014 | 5,800 | 1,866 | 8,680 | -760 | 221,099 |

Scaling Potential

- Modular equipment

- Process automation

- Option to launch 2 shifts or a second line

Conclusion: increasing capacity without significant capital investment makes the project suitable for franchising and EU-wide expansion.

Risks and Mitigation Measures

1. Supply Chain

Issue: delays and rising costs

- Long-term contracts

- Strategic reserve (1–2 months)

- Diversification (2–3 suppliers)

- Real-time monitoring

2. Workforce Qualification

Issue: shortage of trained staff

- Regular training and mentorship

- Equipment supplier training

- Motivation and internal certification system

- Automation of routine processes

3. Equipment Failures

Issue: production downtime

- Scheduled maintenance plan

- Spare parts in stock

- Warranty and urgent service

- Diagnostics and remote monitoring

SWOT / PESTLE Risk Analysis

| Risk | Category | Probability | Impact | Mitigation Measures |

|---|---|---|---|---|

| Raw material price fluctuations | Economic | High | Increased production cost | Long-term contracts, hedging, local suppliers |

| Demand changes | Market | Medium | Sales decline | Market monitoring, flexible pricing, marketing |

| Supply chain disruptions | Technological | Medium | Production delays | Reserves, multi-channel suppliers, IT monitoring |

| Tightening of environmental regulations | Legal | Low | Cost increase | Early certification, eco-technologies |

| Rising competition | Market | Medium | Loss of market share | USP, branding, innovation |

| Currency fluctuations | Economic | Medium | Higher raw material cost | Hedging, settlements in € and CZK |

| Labor shortage | Social | Low | Reduced production pace | Training, motivation, automation |

| Regulatory delays | Political/Legal | Medium | Project launch delays | Legal support, industry associations |

Financial Requirement

Structure

- €78,000 — operating expenses for the first 7 months (raw materials, rent, salaries, logistics, insurance, marketing)

- €20,000 — capital expenditures (equipment, certification, website, marketing)

The investment ensures 7 months of operations without dependency on revenue.

Investment Return Plan

- Stable profitability: from month 5–6

- Break-even point: by month 8–9

- Full return: within 14–16 months

- Horizon: 3 years with potential dividend policy

Investment Attraction Format

- Goal: launch and operational sustainability

- Participation term: 36 months (early exit possible)

- Model: under discussion — repayment + fixed return or equity participation